The Biden administration's August 2023 rules on U.S. investments in China's advanced technology sectors have profound and immediate implications for U.S. technology giants.

A Narrowing Path to Growth

The new rules limit the ability of U.S. tech companies to tap into China's rapidly growing technology market. This is particularly concerning for sectors like AI and semiconductors, where China is making significant strides. The restrictions on U.S. private equity and venture capital investments in targeted Chinese industries could affect strategic investments and partnerships in the region.

Joint Ventures and Collaboration: A Double-Edged Sword

The rules complicate the sharing of intellectual property in joint ventures, affecting the ability to innovate and collaborate effectively with Chinese firms. Any existing or future joint ventures will likely come under increased scrutiny from both U.S. and Chinese regulators, adding layers of complexity to compliance.

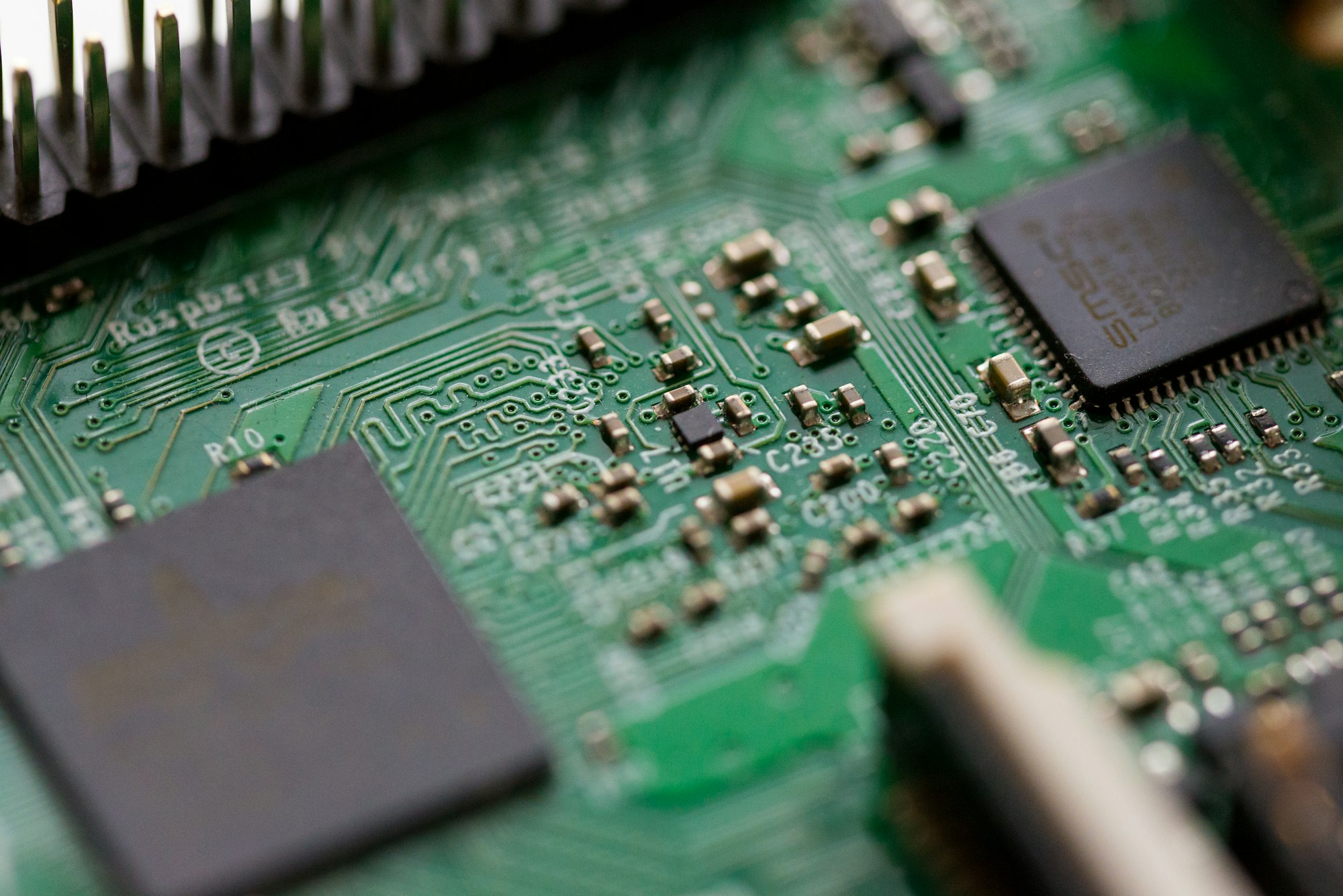

Supply Chain Dynamics: A Fragile Ecosystem

The focus on semiconductors could disrupt the supply chain, given China's role as a significant supplier of raw materials and components. If manufacturing partners in China are affected by these rules, U.S. tech companies may face delays and increased costs, impacting competitiveness.

10 Recommendations

Applicable to most tech companies:

- Localized Product Development: Develop products tailored to the Chinese market that can be wholly produced and sold within China, minimizing the impact of export restrictions.

- Customer Segmentation: Re-evaluate your customer segments in China and other markets based on the new rules. This could involve focusing on industries or customer groups that are less affected by the regulations.

- Intellectual Property Strategy: Revisit your IP strategy to minimize risks associated with technology transfer requirements in joint ventures. Utilize blockchain-based IP protection tools to ensure traceability and ownership.

- Cross-Border Team Alignment: Ensure that your teams across different geographies are aligned in their understanding and response to the new rules. This may involve cross-border training sessions or workshops.

- Scenario Planning: Develop detailed scenario plans for different outcomes, such as further tightening of regulations or easing of restrictions. These should be data-driven and consider multiple variables.

For Software companies:

- Data Sovereignty Compliance: Investigate the feasibility of setting up local data centers in China to comply with data sovereignty laws, thus maintaining service availability.

- SaaS Localization: Customize your software solutions to meet local regulations and cultural norms, which could include language localization and feature adjustments.

- Open Source Strategy: Consider contributing to or leveraging open-source projects that can be freely used in China, thereby sidestepping some of the investment restrictions.

- API Partnerships: Form alliances with Chinese companies that can integrate your services via APIs, thus avoiding the need for direct investment or joint ventures.

- Remote Support Services: Enhance remote customer service capabilities to support Chinese clients without the need for a local presence.

For Hardware companies:

- Local Manufacturing Partners: Explore partnerships with local manufacturers to produce hardware components within China, minimizing export complications.

- Strategic Sourcing: Identify alternative sources for raw material needed in semiconductor manufacturing and include geopolitical stability in your evaluation, along with cost, quality, and other traditional criteria.

- Inventory Strategy: Consider stockpiling critical components in strategic locations outside of China to ensure uninterrupted supply in case of sudden trade restrictions.

- Diversification of Assembly Locations: Evaluate the feasibility of diversifying final assembly locations to countries with stable U.S. relations, such as Japan or South Korea.

- Technology Licensing: Instead of selling physical products, explore the possibility of licensing your technology to Chinese firms for local production.

Conclusion

The August 2023 U.S.-China investment rules necessitate a strategic reevaluation for a broad swath of U.S. tech companies involved with artificial intelligence, quantum computing, and semiconductors. While the situation is fraught with challenges, it also presents opportunities for those willing to adapt and innovate. Those demonstrate a combination of agility, strategic partnerships, and a deep understanding of both local and global market dynamics are likely to be more successful.