An Emerging Strategy Report on Trends, Pain Points and Strategies for Success in the Flooring Industry

The U.S. flooring industry is no longer navigating slow waters. It is navigating discipline. Growth is no longer broad-based or automatic. It is now concentrated in fewer, higher-performing segments and increasingly shaped by sharper buyer expectations. The return of demand has not brought back old buying behavior. Instead, it has exposed structural inefficiencies that many brands are still racing to correct.

Original research conducted for this report, spanning 300+ dealer, designer, and homeowner responses, along with 30+ in-depth interviews, confirms that decision criteria are shifting. Across the channels, stakeholders are less interested in breadth and more interested in clarity, less focused on features, and more interested on fit. The brands gaining ground are those that simplify decisions, reduce friction, and deliver coherence from first impression to final installation.

Flooring brands are not being outcompeted on product quality. They’re being eliminated on clarity, responsiveness, and support. Whether the buyer is a dealer deciding what to recommend, a designer finalizing a spec, or a homeowner choosing what to install, the common thread is friction, and the brands that remove it are gaining share.

Our interviews and surveys reveal recurring breakdowns across the decision journey. The categories seeing the fastest growth, LVT, engineered wood, and now laminate, are no longer competing only on features. They are winning because they are easier to explain, easier to quote, and easier to trust.

What does the report contain?

Results of in-depth interviews and surveys with dealers, designers and homeowners

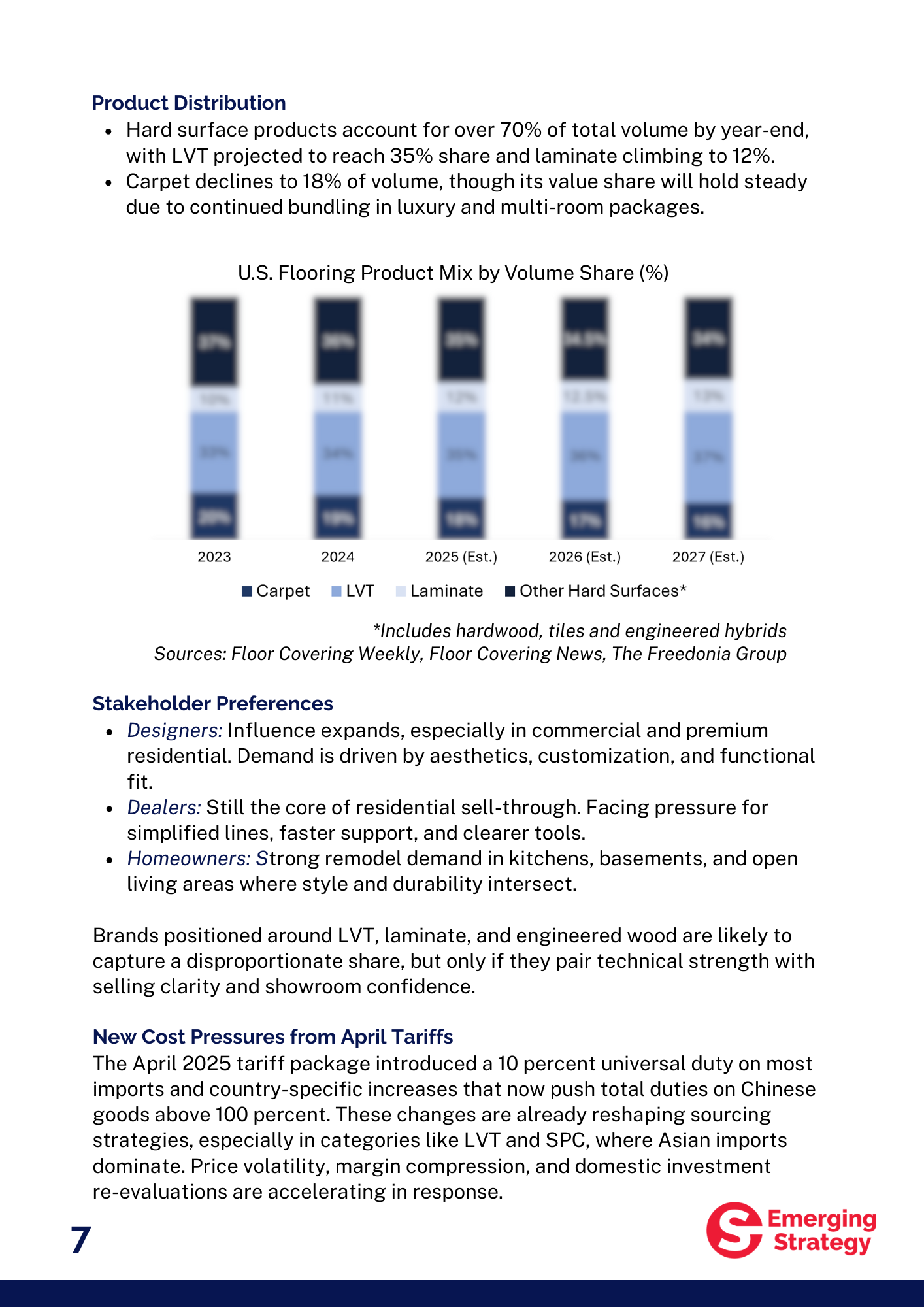

- Key trends in types of flooring gaining popularity

- Pain points identified by dealers and designers affecting flooring sales

- Strategies to reduce friction in flooring distribution and sales channels

... and much more!

Report Preview