Commercial vehicle upfitters are seeing fewer trucks roll into the docks, luxury spending is hitting the brakes, and healthcare institutions are going lean.

Beneath these surface ripples lies a deeper story.

Today we’re marrying whispers we’ve collected from Reddit with search trends, to reveal quiet but telling shifts across multiple sectors of the American economy.

Let's dig into what's actually happening, why it's happening, and why it matters.

Before we proceed, I’d like to give you a taste of something new ⚡ and amazing we’re building:

You’re invited to chat with Dave, our friendly robot 🤖, about this very article.

Just try giving him a ring at +1-202-804-8381

He’s available 24x7!

Feel free to drop me an email later and let me know how it went.

1. Commercial Vehicle Upfitters Signal a Business Slowdown

A whisper from commercial vehicle upfitter Matticus54r posted on 4/24 is telling:

"Commercial vehicle upfitter warehouse d bag here…we upfit work trucks/vans for repair and service companies, .gov, railroad, etc.

The receiving dock is slooooow…we took a noticeable deep decline in inbound inventory last Thursday. The UPS truck used to drop off 30-50 packages a day. Yesterday I got six. FedEx had five. Our main supplier of parts (inside sales/we bought that company years ago) used to send two to three semi loads a week from China and India . $250k or so a truck. Last big shipment was last week. Yesterday I got four pallets from a hotshot driver in a 24 foot box truck that drove from Baltimore to KC.

The warehouse has never been cleaner. No word from up high.”

Why it's happening:

Commercial vehicle purchases are a key indicator of small- to mid-sized business (SMB) health. Current trends reflect:

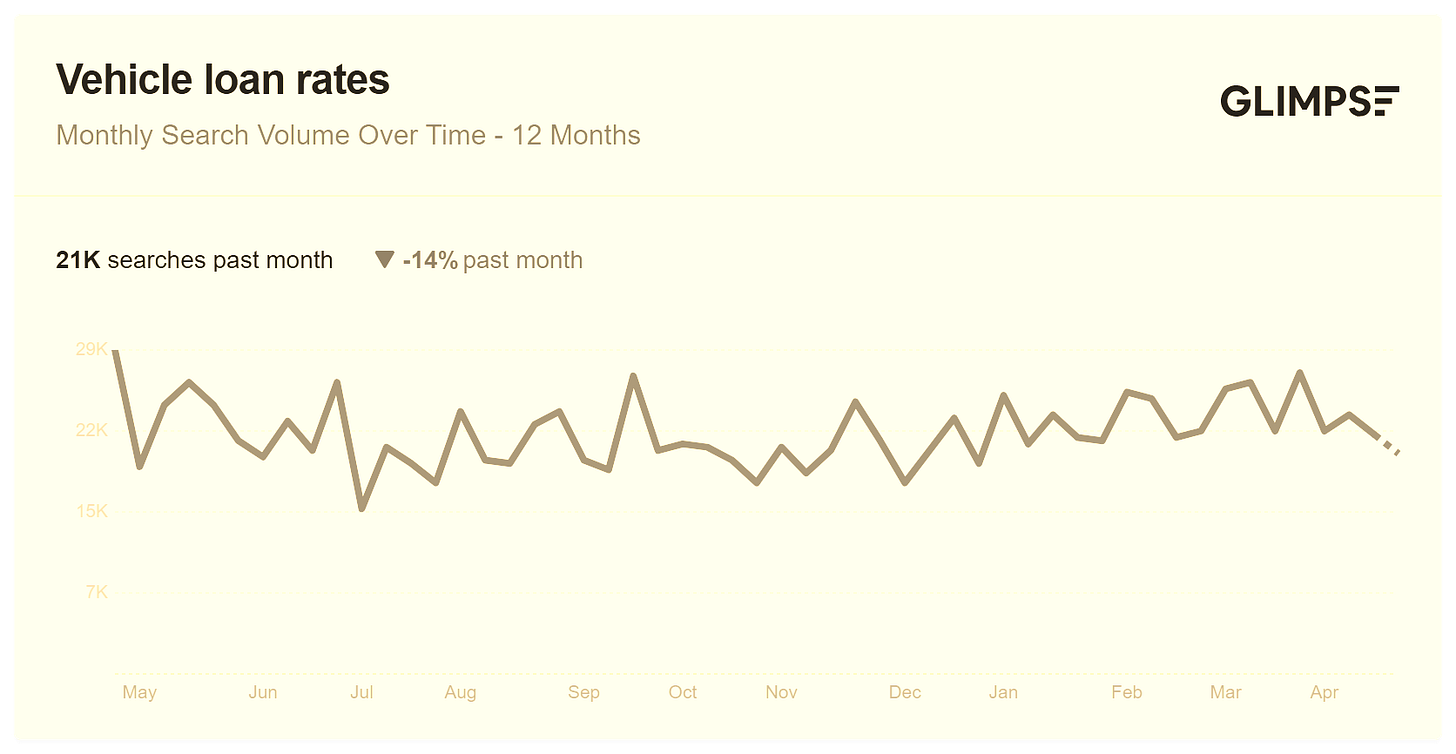

- Economic Anxiety: Rising vehicle financing costs, persistent inflation, and uncertainty about consumer demand are prompting SMBs to pause fleet upgrades or expansions.

So what?

- Small Business Caution Spreading: This slowdown suggests broader SME caution. Expect decreased investment across SMB-supportive sectors (software, equipment, real estate expansions).

- Financing and Credit Tightening: Banks will likely respond with stricter lending criteria, squeezing SMEs further and limiting their flexibility to adapt.

- Logistics Realignment: Logistics firms face immediate revenue contraction as companies in-source inventory management. Conversely, warehouse automation firms and suppliers of automated guided vehicles (AGVs) stand to benefit significantly, with AGV deployments increasing as firms try to offset labor and operational costs.

2. Luxury Spending: High Gold Prices Stall Jewelry Sales

A whisper from jeweler Fickle-Ad1363 on 4/24 highlights current conditions:

"Goldsmith here: Because of the really high Goldprice we sell a lot less jewelry.

On the other hand we get a lot more jewelry to repair and to rework, which is actually a nice trend considering that there is enough gold around and how damaging mining is for nature.

We sell a lot less wedding rings. We work together with other jewelry stores, who bring their repair orders to us and they have noticed the same. One competitor only sold one pair in three months when he normally would have sold ten. We ourselves are down 50%. It’s probably because of less marriages happening. If people were buying online we would have seen a spike in getting new rings to resize them.

A lot more people „pay“ with their old gold jewelry they have laying around at home. That hasn’t happened that much before either.”

Why it's happening:

Luxury and discretionary spending faces multiple headwinds:

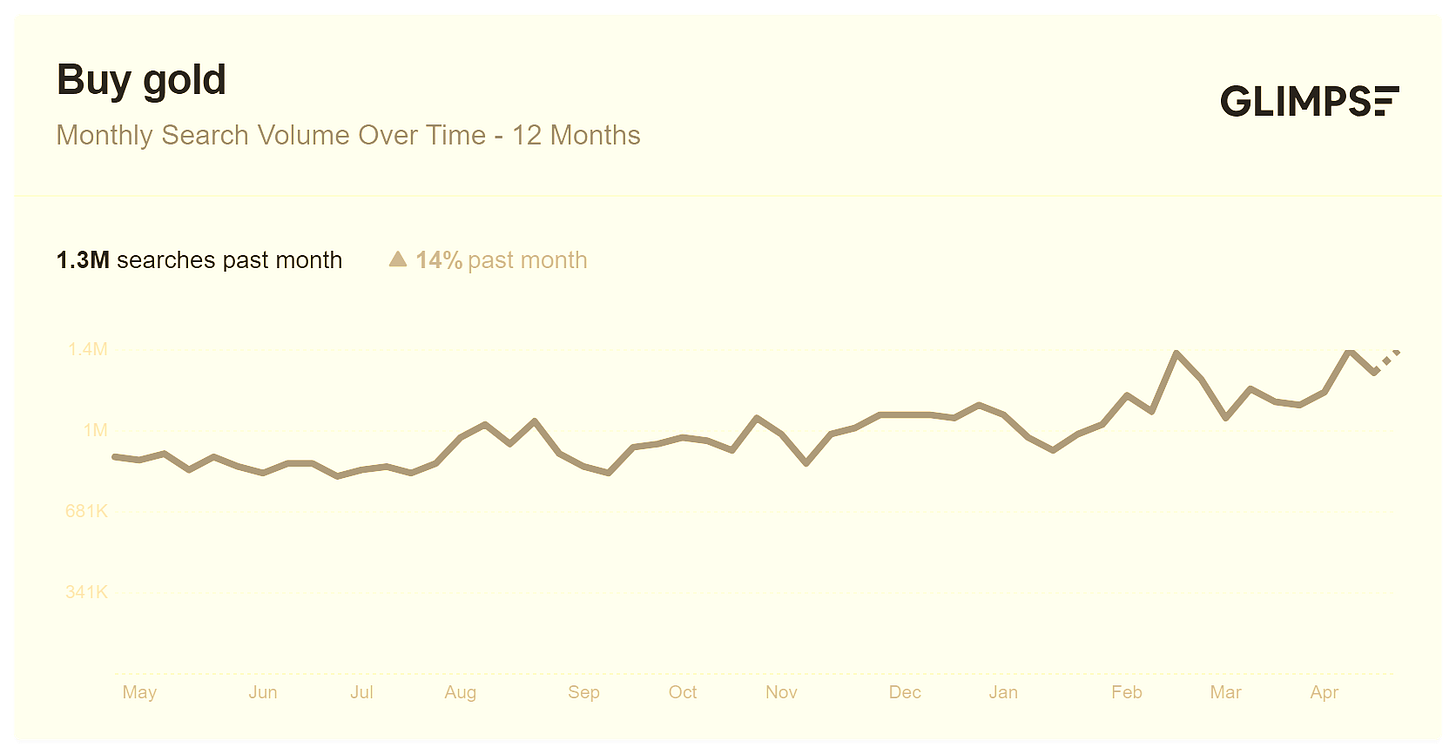

- Gold Price Dynamics & Stealth Inflation: With gold prices hitting record levels ($2,400/oz), mid-tier jewelry buyers are significantly curtailing purchases. High-net-worth individuals (super-prime) still acquire assets, while median households shift discretionary spending to essential items.

- Geopolitical Uncertainty and Inflationary Pressure: Persistent geopolitical tensions and inflation make gold an attractive safe haven, diverting disposable income away from jewelry purchases.

So what?

- Consumer Sentiment Softening and the "K-shaped" Divide: Gold’s sustained high prices (up 20% YoY) act as a stealth inflation tax, redirecting roughly $28 billion annually away from middle-class discretionary spending towards commodity investments. This will deepen existing income polarization, forcing luxury brands to pivot toward "quiet luxury" or discreet branding strategies to mitigate backlash and market insensitivity.

- Retailer Inventory Risks: Luxury retailers will likely face excess inventories, prompting promotions or discounting. However, aggressive discounting risks long-term brand erosion.

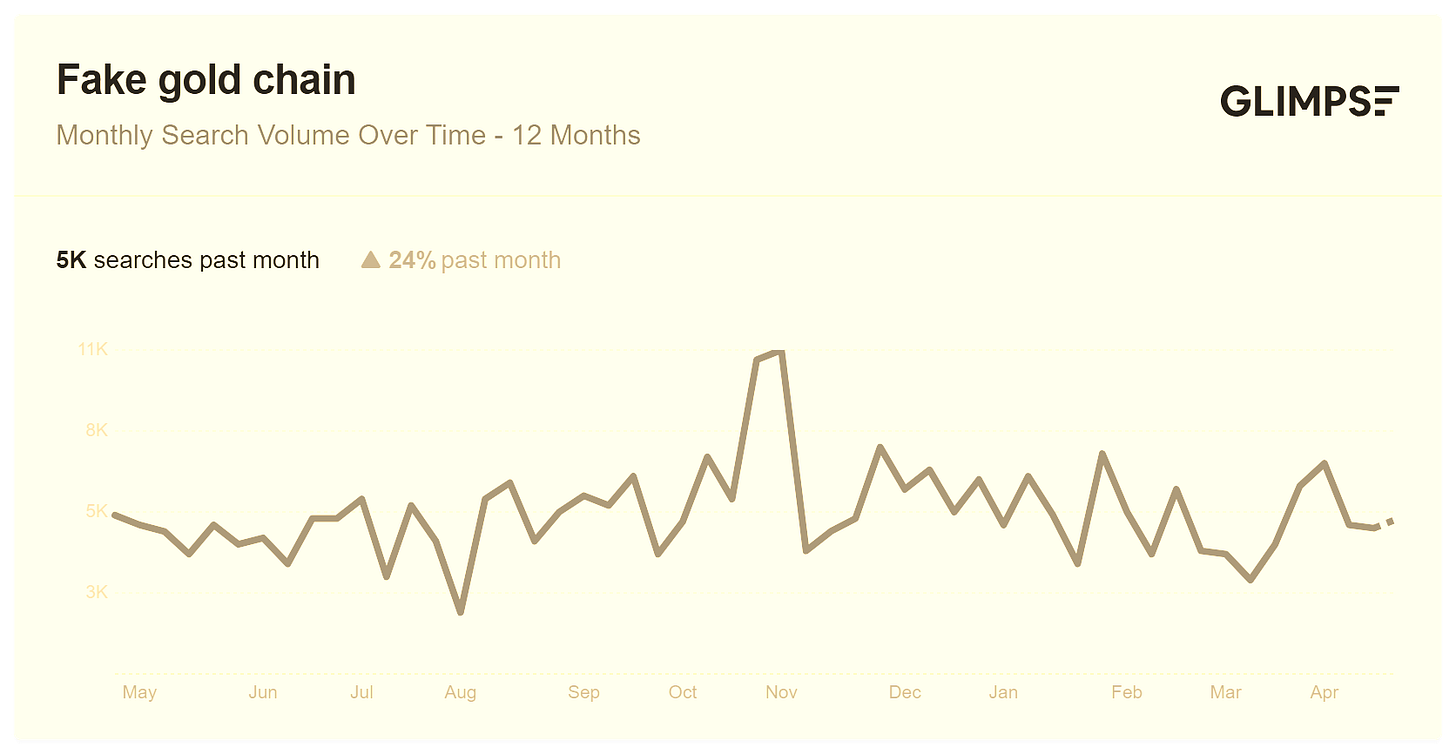

- Investment Implications: Look for a growing appetite for recession-resilient luxury substitutes, such as second-hand and lab-grown jewelry markets, which currently see significant spikes in search interest and demand.

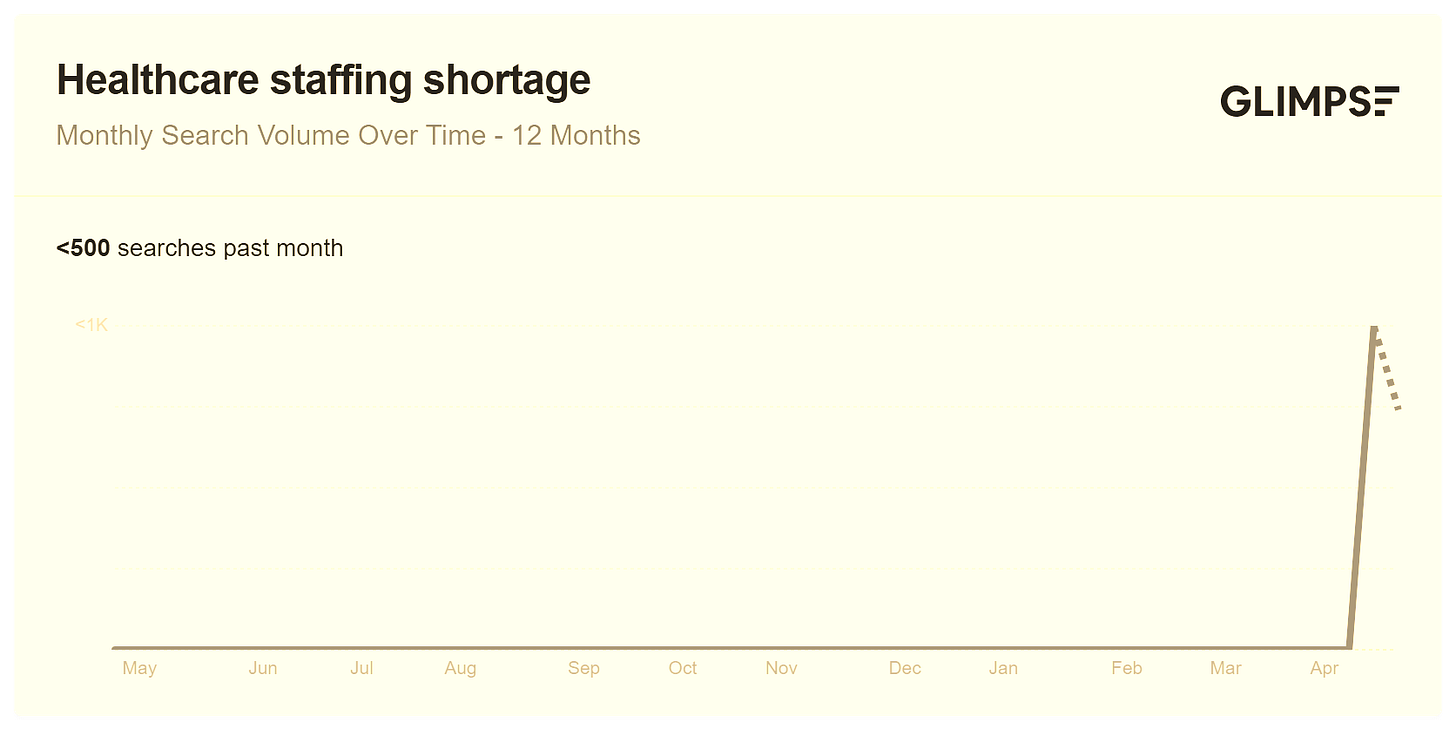

3. Healthcare Gets Lean and Mean

Two troubling signals are quietly emerging in the healthcare industry:

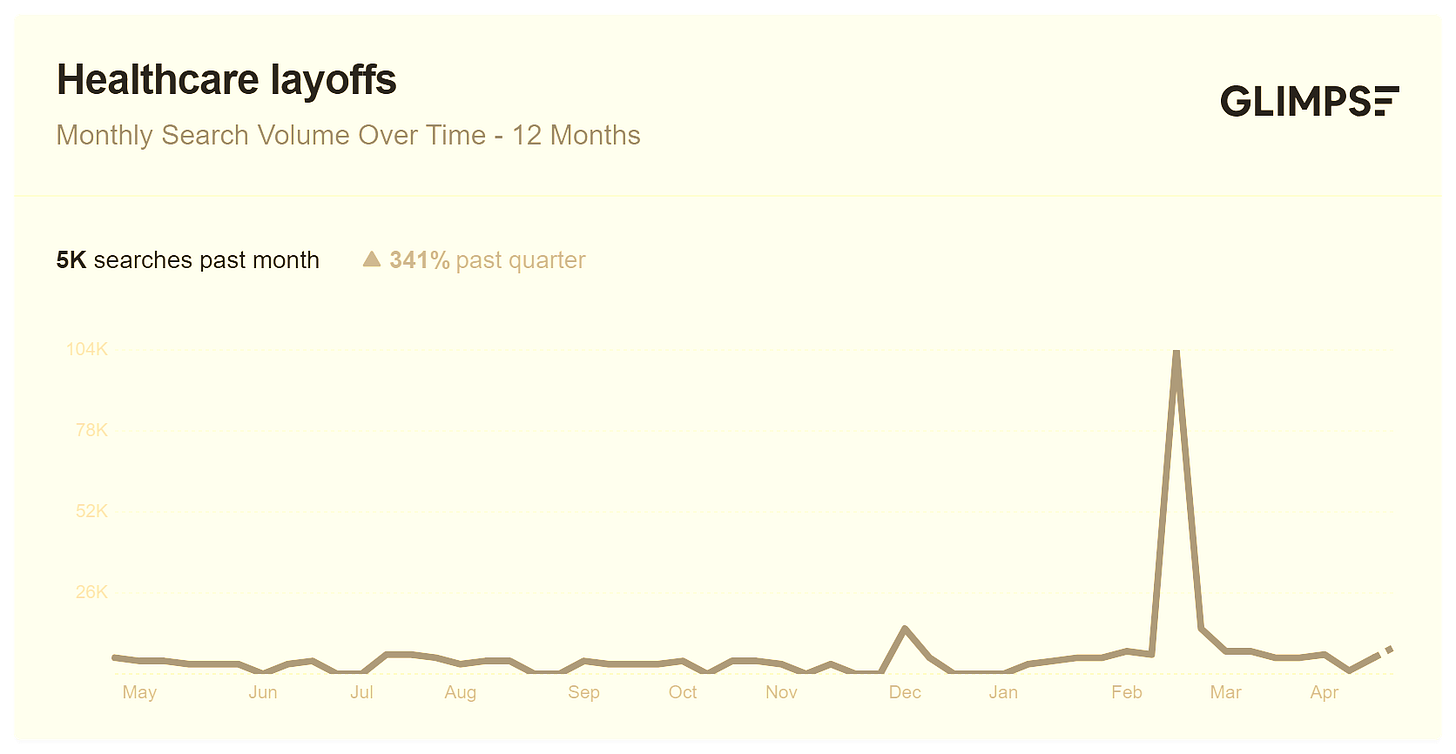

- Major medical centers in the U.S. are eliminating overtime and drastically cutting staffing to "lean" levels.

- In healthcare IT, insiders report hiring freezes and mandates to aggressively slash computing expenses.

Medical staffer Unique-Sock3366 whispers on 4/24:

“Major medical center in Southeast US. It’s official: no overtime, very lean staffing. Administration has been rather gently leading us in this direction since January but it’s balls to the wall now.

Lots of my colleagues are polishing their resumes and applying elsewhere. Ours was an incredibly comfortable gig; I’m not sure that they will find much success finding something comparable.

ETA: I’ve been keeping a close eye on our medical and pharmaceutical supplies. Will update if we see shortages and shifts.”

Meanwhile healthcare IT worker kezfertotlenito whispers:

“I'm a software engineer working for a company that works with healthcare data, mainly Medicare. We are in "lean" mode for sure, hiring essentially frozen & being asked to find places to aggressively cut computing costs.

I had to turn off several functions in our software this week because data we should have been getting from Medicare about claims paid just... didn't arrive. I don't know if that means Medicare didn't pay, or if something else is happening to keep data from being sent out. I don't know that much about the whole process in general, I just know that I was asked to turn off these functions because the data wasn't there and that seems concerning to me.

(and yes, I'm extremely aware that I'm not likely to have a job for very much longer. Just hanging in there until the checks stop coming.)”

Why it's happening:

The healthcare system faces several pressures:

- Labor Cost Escalation Meets Reimbursement Stagnation: Hospital labor costs surged by 18% nationally (2021–2024), vastly outpacing Medicare reimbursement increases (only 2.1% annually, below medical inflation of 3.8%). This mismatch forces hospitals into austerity, not by choice, but as a survival mechanism, resulting in an 11% reduction in contingent labor despite triggering nurse turnover spikes of up to 50%.

- Financial Constraints Post-COVID: Institutions that expanded rapidly during COVID now grapple with depleted federal relief and tightening margins.

- Medicare and Medicaid Uncertainty: Anticipated cuts from CMS reimbursements pressure healthcare IT and administrative budgets—prime areas for short-term cost-cutting measures.

- Immigration Policy: U.S. healthcare depends on immigrants at all levels. As a hardline policy takes hold on the entry of new immigrants and the status of existing immigrants—both legal and undocumented—expect healthcare to face additional staffing pressure.

So what?

- Operational Fragility: Lean methodologies in healthcare (operating at around 95% capacity) leave little room for surges. During the COVID-era, mortality was 23% higher in ICUs that were lean-staffed. Investors may see short-term EBITDA recovery but must brace for medium-term negative impact.

- Delayed Innovation: Healthcare IT spending cuts inevitably stall critical upgrades in cybersecurity and telemedicine. Institutions may become vulnerable to cyberattacks or lag behind in digital health innovations.

- M&A Surge Opportunity: Financially distressed healthcare entities will increasingly appear attractive to private equity investors or larger healthcare systems capable of absorbing financial risks for strategic market consolidation.

Quiet Signals, Loud Implications

None of these signals are headline-grabbers on their own. But taken together, they form a coherent story:

📉 Businesses are retrenching

📉 Households are prioritizing

📉 Institutions are bracing

It’s not a collapse by any means but it IS a recalibration.

And recalibrations often precede bigger shifts.

What we're seeing is the early smoke from a fire not yet visible on the surface:

The signal is not in the noise—it’s in the quiet.

In the absence of sirens, pay attention to the subtle. That’s where the story of the next six months is already being written.

We’ll keep watching. You should too.