The internal combustion engine (ICE) vehicle market is being reshaped by major trade policy shifts from the newly inaugurated Trump administration.

On February 1, 2025, the White House announced sweeping tariffs, targeting Canada, Mexico, and China with the following measures:

- A 25% tariff on all imports from Canada and Mexico.

- A 10% tariff on all imports from China.

- Potential for additional tariffs on auto parts, steel, and aluminum.

These policies are not traditional trade disputes over manufacturing subsidies or trade deficits—they are explicitly linked to illegal immigration and fentanyl trafficking. Regardless of their stated intent, they will have massive ripple effects on the ICE vehicle market, as supply chains in North America and Asia realign.

This article breaks down the key winners and losers in the ICE sector, examining who benefits, who gets hit the hardest, and what automakers must do next.

🌎 How This Trade War Reshapes the ICE Market

1️⃣ U.S. vs. Canada & Mexico: Auto Industry Caught in Political Crossfire

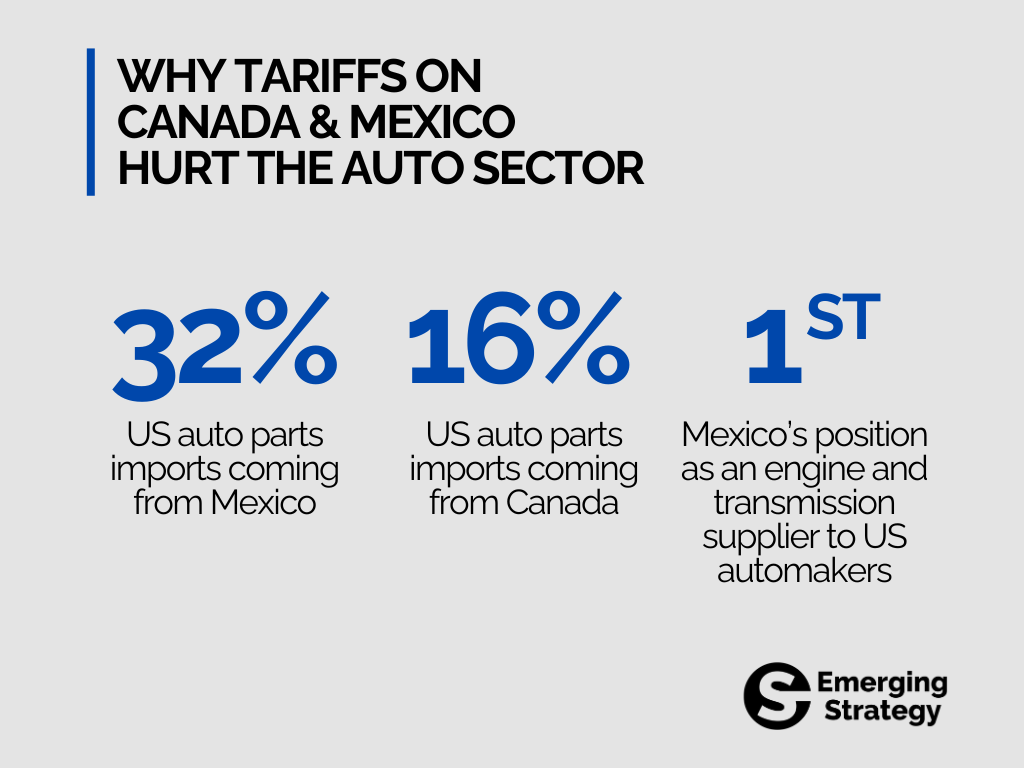

- The 25% tariff on imports from Canada and Mexico is a direct attack on the auto sector, given that:

- 32% of U.S. auto parts imports come from Mexico.

- 16% of U.S. auto parts imports come from Canada.

- Mexico is the #1 supplier of engines and transmissions to U.S. automakers.

- Canada is a key supplier of aluminum and steel used in ICE vehicles.

- Who’s hit hardest?

- Ford, GM, and Stellantis, which rely on Mexican and Canadian factories to assemble ICE vehicles.

- Japanese and European brands (Toyota, Volkswagen, Honda, BMW) that produce ICE vehicles in Mexico for the U.S. market.

- Parts suppliers like Magna (Canada) and Nemak (Mexico), whose biggest customers are U.S. automakers.

- Short-term impact: Automakers will likely pass cost increases on to consumers, leading to higher ICE vehicle prices.

2️⃣ U.S. vs. China: ICE Parts Costs Rise Due to Tariffs

- The new 10% tariff on Chinese goods affects steel, aluminum, transmissions, sensors, and electronics—critical components for ICE cars.

- Who’s hit hardest?

- ICE automakers are deeply reliant on Chinese engine sensors, steel, and rare earth materials.

- Suppliers like Bosch, Continental, and ZF Friedrichshafen, which manufacture ICE vehicle parts in China for global distribution.

- Short-term impact:

- Expect higher prices for replacement parts and maintenance in the U.S. ICE aftermarket.

- Automakers that haven’t diversified away from China will face rising costs.

3️⃣ The EU and Japan: Benefiting from Trade Diversions?

- The U.S. tariffs may push some automakers to shift sourcing to Japan and Europe rather than rely on China.

- Winners:

- Japanese auto parts suppliers (Denso, Aisin, Hitachi Astemo) could see increased demand.

- European suppliers (Schaeffler, Valeo, Bosch) may gain contracts as U.S. automakers pivot away from China.

- Short-term impact:

- Higher costs, but long-term supply chain diversification.

🏆 Winners: Who Gains from the Multi-Front Trade War?

1️⃣ Asian Auto Parts Makers (Outside China): The New Sourcing Hubs

🔹 Winners: Denso (Japan - 6902.T), Aisin (Japan - 7259.T), Hyundai Mobis (South Korea - 012330.KQ), Tata Autocomp (India - Private), Thai Summit Group (Thailand - Private)

💡 Why They Win:

- U.S. and EU automakers need alternatives to Chinese parts to avoid new tariffs.

- Japanese, South Korean, Indian, and Southeast Asian suppliers already have established high-quality, low-cost production.

- Automakers will shift procurement of engines, transmissions, sensors, and metal components to these regions.

📌 Implication: - Asian suppliers (outside China) gain major contracts, accelerating investment in Thailand, India, Vietnam, and Japan as key ICE parts hubs.

2️⃣ U.S. Auto Parts Manufacturers: The Forced Reshoring Effect

🔹 Winners: BorgWarner (USA - BWA), Eaton (USA - ETN), American Axle (USA - AXL), Dana (USA - DAN)

💡 Why They Win:

- Tariffs on Mexico and China create incentives to produce more domestically.

- Automakers will rely more on U.S.-made transmissions, axles, and electronic components.

📌 Implication: - U.S. suppliers will gain business but at a higher cost.

3️⃣ Automakers With Limited Exposure to Mexico & China

🔹 Winners: Toyota (Japan - TM), Honda (Japan - HMC), Hyundai (South Korea - HYMTF)

💡 Why They Win:

- Toyota and Honda heavily rely on U.S. and Japanese production, with less exposure to Mexican supply chains.

📌 Implication: - Minimal short-term disruption, potential long-term supply chain adjustments.

🚨 Losers: Who Suffers in the Multi-Front Trade War?

1️⃣ U.S. Automakers Dependent on Mexico & Canada

🔹 Losers: Ford (USA - F), GM (USA - GM), Stellantis (Netherlands - STLA)

💡 Why They Lose:

- Ford, GM, and Stellantis rely on Mexican production for engines, transmissions, and finished vehicles.

📌 Implication: - U.S. consumers will see higher car prices as costs rise.

2️⃣ Mexican and Canadian Auto Industries

🔹 Losers: Magna (Canada - MGA), Linamar (Canada - LNR.TO), Nemak (Mexico - NEMAK.MX)

💡 Why They Lose:

- Mexico is a major supplier of auto parts, engines, and assembled vehicles to the U.S.

- Canada’s aluminum industry (a key material for ICE vehicles) is hit by tariffs.

📌 Implication: - Job losses and potential shifts in supply chains.

3️⃣ Chinese Auto Parts & Materials Suppliers

🔹 Losers: Weichai Power (China - WEICF), CATL (China - 300750.SZ), BYD (China - BYDDY)

💡 Why They Lose:

- The 10% tariff on Chinese goods makes it harder for U.S. automakers to source materials from China.

📌 Implication: - China may increase investment in Southeast Asia to bypass tariffs.

📉 Final Scorecard: Who’s Up, Who’s Down?

|

Category |

Winners |

Losers |

|

Auto Parts |

BorgWarner,

Eaton, Dana and various Japanese, Korean, Indian and Southeast Asian players |

China,

Canada, and Mexico-based suppliers |

|

Automakers |

Toyota,

Honda, Hyundai |

Ford, GM,

Stellantis |

Final Thoughts: What’s Next for ICE Automakers?

- Automakers will pass costs to consumers. Expect higher vehicle prices in the U.S.

- Supply chains will shift. Asia ex-China will gain at Mexico, Canada and China’s expense.